Single Family Home vs Multi Family Home: The Ultimate Real Estate Investment Guide

Commercial Real Estate vs Residential Real Estate: Key Differences for Investors

Understanding the key differences between commercial and residential real estate is crucial for any real estate investor looking to make informed investment decisions. Whether you're new to real estate investing or considering expanding your portfolio, choosing between commercial and residential properties requires careful consideration of multiple factors.

Commercial Real Estate vs Residential Properties: Understanding the Basics

Definition of Commercial Real Estate

Commercial real estate refers to property that is used for business purposes or to generate rental income through commercial activities. The definition of commercial real estate encompasses office buildings, retail spaces, warehouses, industrial facilities, and multi-family properties with five or more units. These commercial properties are typically classified as commercial real estate due to their business-oriented nature and income-generating potential.

Definition of Residential Real Estate

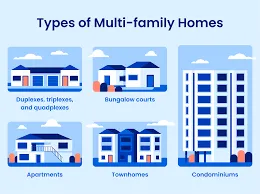

Residential real estate refers to properties designed for people to live in, including single-family homes, condominiums, townhouses, and small multi-family properties with four or fewer units. Residential properties are generally easier to understand and manage, making them attractive to investors who are new to real estate investing.

Key Differences Between Commercial and Residential Real Estate

Commercial vs Residential: Investment Requirements

The differences between commercial and residential real estate investments begin with capital requirements. Commercial real estate typically requires significantly more upfront investment compared to residential properties. Commercial properties are often larger and much more expensive than residential properties, requiring substantial down payments and higher cash reserves.

When you invest in commercial real estate, you're dealing with properties that serve businesses and generate income through commercial lease agreements. These commercial properties offer higher potential returns but also come with increased complexity and risk.

Commercial and Residential Real Estate: Financing Differences

Financing for commercial and residential properties differs significantly. Residential real estate typically qualifies for conventional mortgage loans with favorable terms and lower down payment requirements. Commercial real estate financing, however, often requires larger down payments, higher interest rates, and more stringent qualification criteria.

Commercial real estate investors must demonstrate stronger financial positions and business experience to secure financing. The commercial real estate transaction process is typically more complex than residential deals, requiring extensive due diligence and documentation.

Types of Commercial Real Estate vs Residential Properties

Commercial Properties: Diverse Investment Opportunities

The types of commercial real estate include office buildings, retail centers, industrial warehouses, hotels, and large apartment complexes. Each type of commercial property serves different business needs and offers varying risk and return profiles.

Commercial properties offer higher rental income potential due to longer lease terms and the ability to charge premium rents to businesses. Commercial leases are typically structured differently than residential leases, often including provisions for rent increases and tenant responsibility for maintenance costs.

Residential Properties: Steady Income Streams

Residential properties encompass single-family homes, condominiums, townhouses, and small multi-family buildings. These properties used for housing provide steady rental income and are generally more liquid than commercial properties.

Residential and commercial properties serve different market segments, with residential properties catering to individual housing needs and commercial properties serving business requirements.

Commercial vs Residential Real Estate: Investment Considerations

Risk and Return Analysis

When choosing between commercial and residential real estate investments, consider that commercial properties offer higher potential returns but also carry increased risk. Commercial real estate offers the possibility of significant cash flow and appreciation, but requires more active management and market expertise.

Residential real estate investments typically provide more stable, predictable returns with lower volatility. The residential market tends to be less susceptible to economic downturns compared to commercial properties, which can be heavily impacted by business cycles.

Management and Operational Differences

Commercial real estate management involves dealing with business tenants who may have specific operational requirements and longer-term lease commitments. Commercial and residential properties require different management approaches, with commercial properties often demanding more sophisticated property management strategies.

Residential properties are generally easier to manage, with standardized lease agreements and more predictable tenant needs. However, residential properties may experience higher tenant turnover compared to commercial properties with long-term leases.

Commercial Real Estate Agents vs Residential Agents

Specialized Expertise Requirements

Working with commercial real estate agents requires finding professionals with specialized knowledge of commercial markets, valuation methods, and complex lease structures. Commercial real estate agents understand the intricacies of commercial transactions and can navigate the more complex regulatory environment that governs commercial properties.

Residential real estate agent professionals focus on helping clients buy and sell homes, understanding residential market trends, and managing standard residential lease agreements. The differences between residential and commercial agents reflect the distinct skill sets required for each property type.

Commercial and Residential Agents: Service Differences

Commercial and residential agents provide different types of services based on their respective markets. Commercial agents often work with business owners, developers, and institutional investors, while residential agents primarily serve individual homebuyers and small-scale investors.

A good real estate agent can help you understand your real estate needs and guide you toward the most appropriate investment strategy. Whether you hire a real estate professional for commercial or residential transactions, choosing someone with relevant experience in your target property type is essential.

Invest in Commercial Real Estate vs Residential Real Estate Investing

Getting Started: Commercial Real Estate Investing

When you invest in commercial real estate, you're entering a market that requires substantial capital, extensive due diligence, and sophisticated market knowledge. Commercial real estate investing involves analyzing complex financial statements, understanding lease structures, and evaluating business fundamentals of tenant companies.

Commercial real estate investments typically require larger initial investments but can provide superior cash flow and long-term appreciation potential. However, getting started in commercial real estate often means working with commercial real estate investors who have experience navigating this complex market.

Residential Real Estate Investing: Accessible Entry Point

Residential real estate investing provides a more accessible entry point for new investors. The barriers to entry are lower, financing options are more readily available, and the market dynamics are easier to understand.

Residential investments can include single-family rental properties, small multi-family buildings, and condominiums. These residential real estate investments offer steady rental income and the potential for long-term appreciation, making them attractive to investors seeking predictable returns.

Commercial vs Residential Real Estate: Market Dynamics

Economic Sensitivity and Market Cycles

Commercial properties are typically more sensitive to economic cycles than residential properties. During economic downturns, businesses may downsize or close, affecting occupancy rates and rental income from commercial properties. Commercial real estate is usually the first to decline during recessions and may take longer to recover.

Residential real estate typically shows more stability during economic fluctuations, as people always need housing regardless of economic conditions. This stability makes residential properties attractive to conservative investors seeking consistent returns.

Lease Structures and Income Stability

Commercial leases are typically longer-term agreements that can provide stable income for extended periods. Commercial lease agreements often include rent escalation clauses, maintenance responsibilities for tenants, and other provisions that can benefit property owners.

Residential leases are typically shorter-term agreements, usually one year, which can provide more flexibility but also more frequent turnover. The shorter lease terms in residential properties may result in more management-intensive investments but also allow for quicker rent adjustments to market rates.

Commercial Real Estate vs Residential: Investment Strategy Considerations

Portfolio Diversification Benefits

Understanding the differences between commercial and residential real estate helps investors make informed decisions about portfolio diversification. Many successful real estate investor professionals include both commercial and residential properties in their portfolios to balance risk and return.

The two types of real estate serve different purposes in an investment portfolio. Commercial properties can provide higher returns and cash flow, while residential properties offer stability and easier management.

Risk Management Approaches

Commercial real estate offers higher potential returns but requires active management and deep market knowledge. The complexity of commercial real estate transactions and ongoing management makes this property type more suitable for experienced investors or those willing to work with professional property management companies.

Residential properties are generally easier to understand and manage, making them suitable for investors who prefer a more hands-on approach or those just getting started in real estate investing.

Financing for Commercial and Residential Properties

Lending Requirements and Terms

The differences between residential and commercial financing reflect the different risk profiles of these property types. Residential real estate typically qualifies for government-backed loan programs and conventional mortgages with favorable terms.

Commercial real estate financing typically requires higher down payments, often 20-30% or more, and may have shorter amortization periods and higher interest rates. Lenders evaluate commercial properties based on their income-generating potential and the creditworthiness of tenants.

Investment Analysis Methods

When evaluating commercial or residential real estate investments, different analysis methods apply. Commercial properties are typically evaluated based on net operating income, capitalization rates, and cash-on-cash returns.

Residential properties are often analyzed using comparable sales, rental yield calculations, and cash flow analysis. The simpler analysis methods for residential properties make them more accessible to beginning investors.

Choosing Between Commercial and Residential Real Estate

Investment Goals and Risk Tolerance

Your real estate needs and investment goals should guide your decision between commercial and residential properties. If you're seeking higher returns and have substantial capital available, commercial real estate investments might be appropriate. If you prefer stable, predictable income with easier management, residential real estate investments may be better suited to your goals.

Consider your experience level, available capital, and risk tolerance when choosing between commercial and residential real estate. Both property types can be successful investments when properly selected and managed.

Market Research and Due Diligence

Successful investing in commercial property requires extensive market research and due diligence. You must understand local market conditions, tenant quality, lease terms, and property condition before making investment decisions.

Residential real estate investing also requires market research, but the analysis is typically more straightforward. Understanding local rental markets, school districts, and neighborhood trends can help you make informed residential investment decisions.

The Future of Commercial and Residential Real Estate

Technology and Market Evolution

Both commercial and residential real estate markets continue to evolve with technological advances and changing consumer preferences. Commercial real estate management increasingly relies on technology for tenant services, building automation, and operational efficiency.

Residential and commercial properties both benefit from technological improvements in property management, tenant screening, and maintenance coordination. These advances help property owners optimize their investments regardless of property type.

Investment Opportunities

The real estate market continues to offer opportunities in both commercial and residential sectors. Great commercial real estate investments can be found in emerging markets, while residential opportunities exist in growing suburban and urban areas.

Both commercial properties and residential properties will continue to play important roles in diversified investment portfolios. Understanding the main differences between commercial and residential real estate enables investors to make informed decisions that align with their investment objectives.

Whether you choose to invest in real estate through commercial properties, residential properties, or a combination of both, success depends on thorough market research, proper due diligence, and ongoing property management. The key is matching your investment strategy to your financial goals, risk tolerance, and management capabilities.

Reventure Solutions LLC specializes in helping investors navigate both commercial and residential real estate markets. Our team provides expert guidance to help you make informed investment decisions that align with your financial objectives and risk tolerance.